In January, Fed Vice Chair Stanley Fischer predicted that four rate hikes were “in the ballpark” for 2016.

Of course here we are at the end of September, with only two Fed meetings remaining for the year, and the Fed has yet to hike rates even once.

In its statement for its September meeting, the FOMC noted that the case for a rate hike has strengthened, but that it is waiting for “further evidence of continued progress toward its objectives” before moving ahead with a rate hike.

Looking at the Fed’s “dot plot,” all FOMC members still believe at least one rate hike will occur by the end of the year, but that’s down from the two rate hikes that were expected in the June projections.

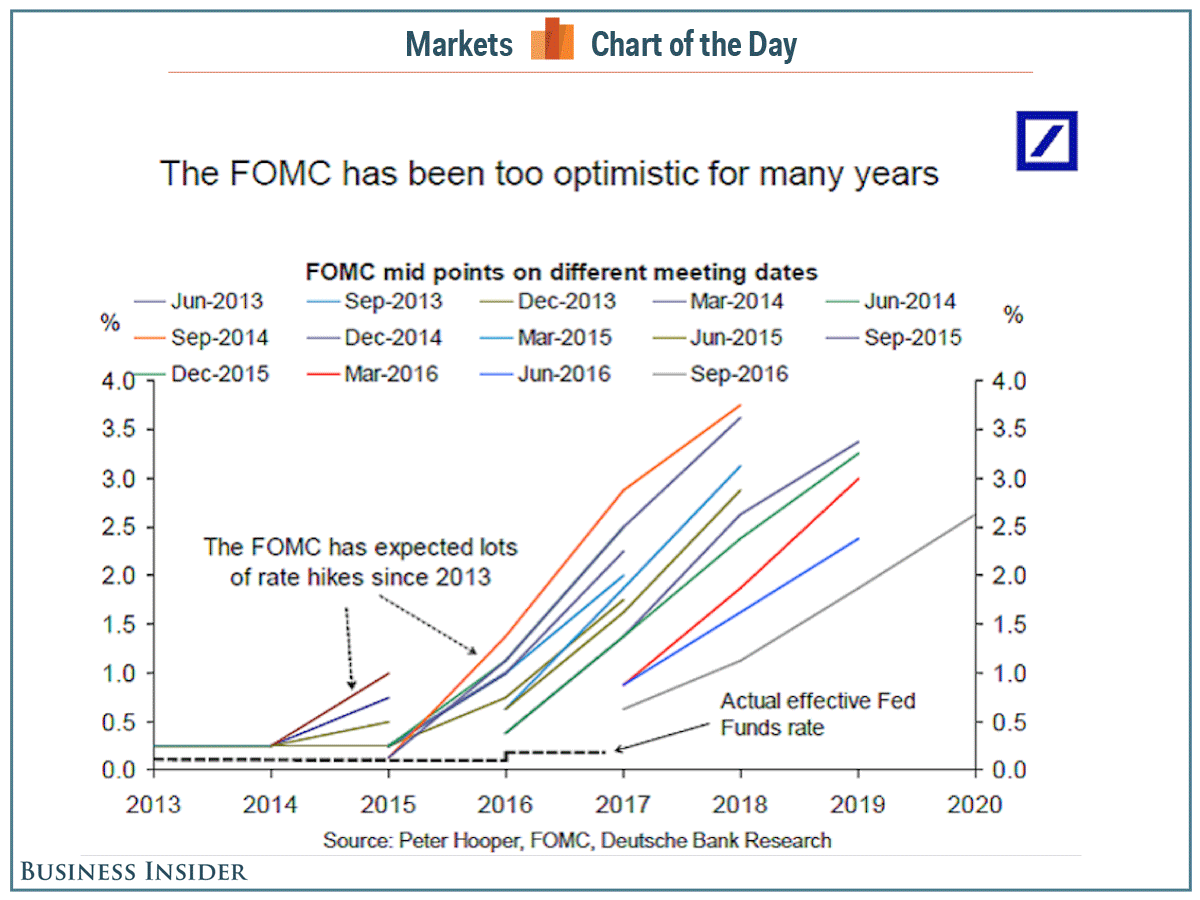

And that’s the problem. The Federal Open Market Committee has been “too optimistic for too many years,” Deutsche Bank’s Torsten Sløk wrote in a note to clients.

Each and every year the Fed expects lots of rate hikes only to see the year come and go with little or no action.

Take a look at the projections over the last three years. Not good.